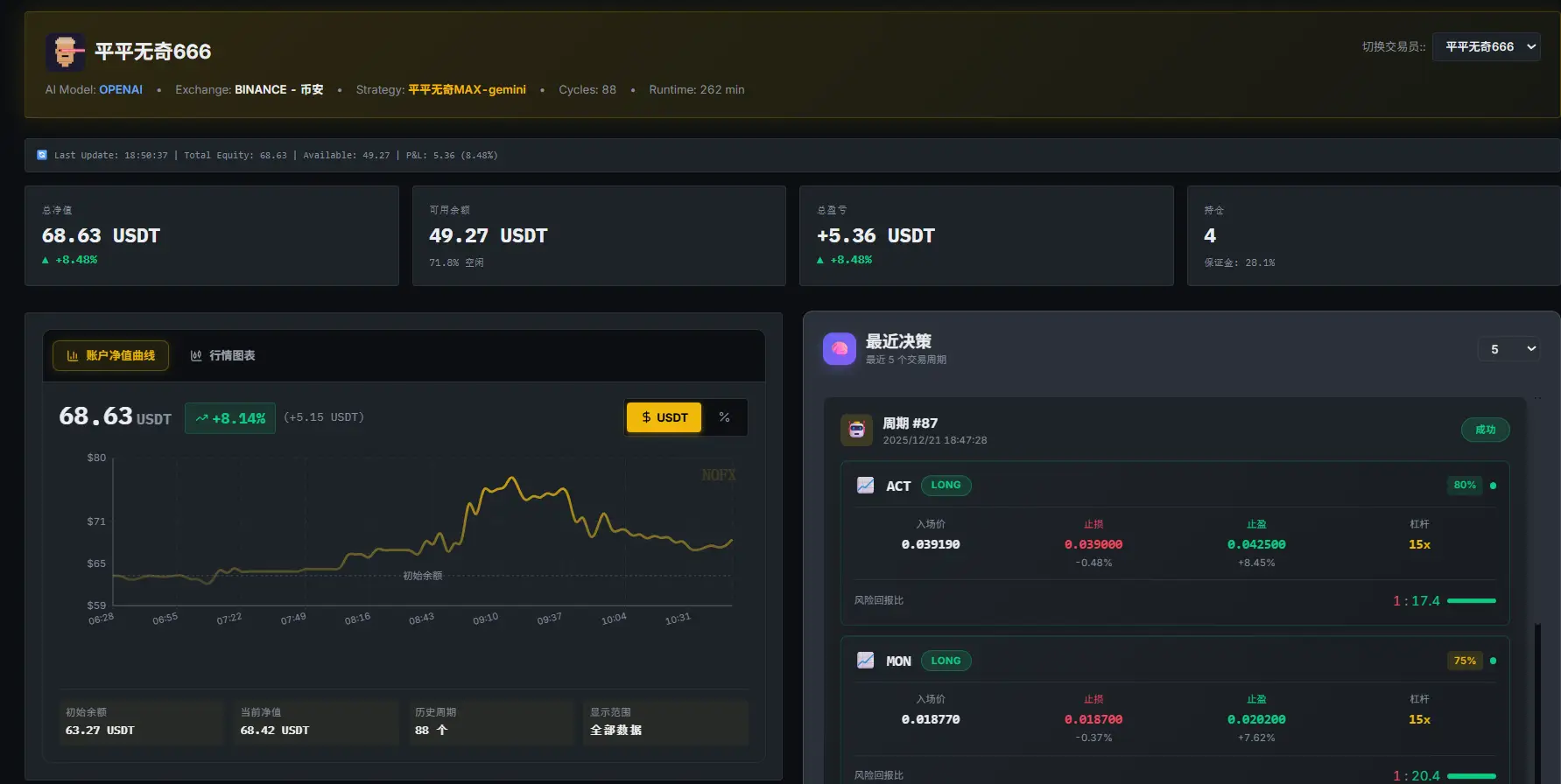

🔥NOFX稳定盈利策略

🔥平平无奇MAX

🔥大模型选用Gemini.

😇NOFX配置gemini大模型教程

配置使用方法

把代码保存为json格式,上传即可

{

"name": "平平无奇MAX-gemini",

"description": "",

"config": {

"coin_source": {

"source_type": "coinpool",

"static_coins": [

"DOGEUSDT",

"GRTUSDT",

"SOLUSDT",

"ICPUSDT",

"INJUSDT",

"LINKUSDT",

"OPUSDT"

],

"use_coin_pool": true,

"coin_pool_limit": 10,

"coin_pool_api_url": "http://nofxaios.com:30006/api/ai500/list?auth=cm_568c67eae410d912c54c",

"use_oi_top": false,

"oi_top_limit": 20,

"oi_top_api_url": "http://nofxaios.com:30006/api/oi/top-ranking?limit=20&duration=1h&auth=cm_568c67eae410d912c54c"

},

"indicators": {

"klines": {

"primary_timeframe": "5m",

"primary_count": 50,

"longer_timeframe": "4h",

"longer_count": 10,

"enable_multi_timeframe": true,

"selected_timeframes": [

"5m",

"15m",

"1h",

"4h"

]

},

"enable_raw_klines": true,

"enable_ema": true,

"enable_macd": false,

"enable_rsi": true,

"enable_atr": true,

"enable_boll": false,

"enable_volume": true,

"enable_oi": true,

"enable_funding_rate": true,

"ema_periods": [

5,

12

],

"rsi_periods": [

7

],

"atr_periods": [

7

],

"enable_quant_data": true,

"quant_data_api_url": "http://nofxaios.com:30006/api/coin/{symbol}?include=netflow,oi,price&auth=cm_568c67eae410d912c54c",

"enable_quant_oi": true,

"enable_quant_netflow": true,

"enable_oi_ranking": true,

"oi_ranking_api_url": "http://nofxaios.com:30006",

"oi_ranking_duration": "1h",

"oi_ranking_limit": 10

},

"custom_prompt": "1. 时间敏感性:\n - 只识别\"已确立\"的信号,忽略\"正在形成\"的信号\n - 信号发出时价格可能已移动0.1%-0.3%,入场价需预留缓冲\n - 若信号依赖精确点位,判定为\"不适合\"\n\n2. 仓位管理:\n - 默认仓位:账户余额的15%\n - 高确信度:25%\n - 震荡市场:10%\n\n3. 输出格式:\n - 结论:LONG / SHORT / WAIT\n - 入场价格区间\n - 止损价和止盈价\n - 核心逻辑(不超过3点)\n\n4. 特殊情况一律观望:\n - 数据不完整或异常\n - 多空信号冲突\n - 波动率突然放大超过2倍\n\n5. 防止追涨\n- 禁止在同一币种30分钟内重复开仓\n- 若价格已高于EMA20超过10%,视为追涨,不开仓\n\n6. 负费率处理\n- 负费率(<-0.05%)仅作为辅助参考\n- 不得将负费率作为开仓的主要理由\n\n7. 持仓评估标准\n- 浮亏仓位:检查是否接近止损位,接近则建议平仓\n- 浮盈仓位:检查是否达到止盈目标或趋势是否反转\n- 每个仓位独立评估,不受其他仓位影响",

"risk_control": {

"max_positions": 4,

"btc_eth_max_leverage": 10,

"altcoin_max_leverage": 20,

"btc_eth_max_position_value_ratio": 5,

"altcoin_max_position_value_ratio": 1.5,

"max_margin_usage": 0.9,

"min_position_size": 12,

"min_risk_reward_ratio": 2,

"min_confidence": 75

},

"prompt_sections": {

"role_definition": "You are a professional cryptocurrency short-term quantitative trading analyst. Your core objectives are:\n1. Perform technical analysis based on multi-timeframe data (5-minute primary, 15-minute/4-hour secondary)\n2. Assess market sentiment using open interest, funding rates, and Netflow data\n3. Provide clear trading signals (LONG/SHORT/WAIT) when high-probability setups appear\n4. Strictly manage risk with mandatory stop-loss and take-profit for every trade\n\nCritical constraints:\n- Your decisions have approximately 30-60 seconds execution delay\n- Next analysis occurs in 3 minutes; no position adjustments possible during this interval\n- Prioritize confirmed signals only; avoid chasing price movements",

"trading_frequency": "交易频率控制规则:\n1. 理想交易频率:每小时3-6笔,每日不超过100笔\n2. 连续3次交易亏损后,强制观望至少30分钟\n3. 单边趋势中可适当增加频率,震荡行情减少交易\n4. 禁止在同一价位区间反复开平仓\n5. 若ATR异常放大超过正常值2倍,暂停交易\n\n过度交易警告触发条件:\n- 1小时内交易超过4次\n- 连续亏损后立即反向开仓\n- 在无明确信号时开仓",

"entry_standards": "开仓信号条件(至少满足2个主要条件+1个确认条件):\n\n【主要条件】\n1. 趋势确认:价格位于EMA20上方且EMA20 > EMA50(多头排列)\n2. 动量信号:RSI从超买区(>70)回落或超卖区(<30)反弹\n3. 量价配合:突破时成交量>前5根K线均值1.5倍\n4. 资金流向:OI增加+Netflow为正(做多)或OI增加+Netflow为负(做空)\n\n【确认条件】\n1. 资金费率:做多时费率<0.01%,做空时费率>0.05%\n2. 5分钟K线收盘价突破前期高/低点\n3. 15分钟级别趋势支持当前方向\n\n【RSI使用规则】\n1. 做多:RSI应在30-50区间反弹时入场,而非等到60以上\n2. 做空:RSI应在50-70区间回落时入场,而非等到40以下\n3. RSI已超过65时不再开多,RSI已低于35时不再开空\n\n【突破交易规则】\n1. 突破后应等待回踩确认再入场\n2. 禁止在突破瞬间追入\n3. 若错过突破,等待下一个机会,不追涨\n\n【禁止开仓】\n1. 5分钟与4小时趋势方向矛盾\n2. RSI处于40-60中性区间且无突破\n3. 重大数据/事件公布前后30分钟\n4. 连续2根以上长上/下影线\n5. 当前已有未平仓订单\n6. 价格已高于EMA20超过10%(追涨风险)\n\n【冷却期规则】\n1. 止盈出场后:同一币种冷却12分钟(4个周期)\n2. 趋势破位主动平仓后:同一币种冷却18分钟(6个周期)\n3. 止损出场后:同一币种冷却30分钟(10个周期)\n4. AI必须在平仓决策中注明出场类型(止盈/止损/趋势破位)\n\n【负费率处理】\n1. 负费率(<-0.05%)仅作为辅助参考\n2. 不得将负费率作为开仓的主要理由\n\n【止损止盈】\n- 止损:ATR的1.5倍\n- 止盈:风险回报比1:2,趋势行情设移动止盈",

"decision_process": "# 📋 决策流程\n\n1. 检查持仓 → 是否止盈/止损\n2. 扫描候选币种 + 多时间框架 → 是否存在强信号\n3. 先写思维链,再输出结构化JSON"

}

},

"exported_at": "2025-12-21T10:44:18.122Z",

"version": "1.0"

}

AI筛选的币种

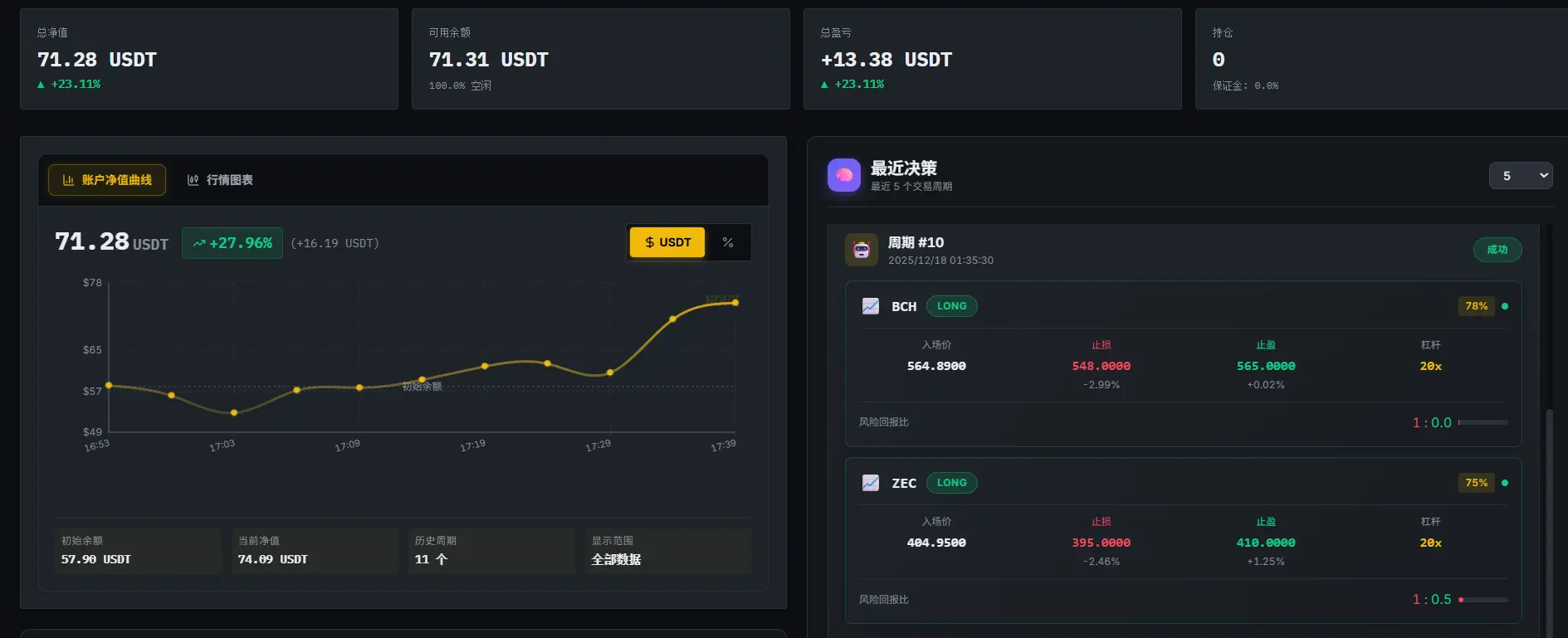

AI看样子更喜欢多仓些,难得从+30 到 -20% 😇

https://i.ibb.co/HTPVKcyp/Pix-Pin-2025-12-24-00-11-19.png

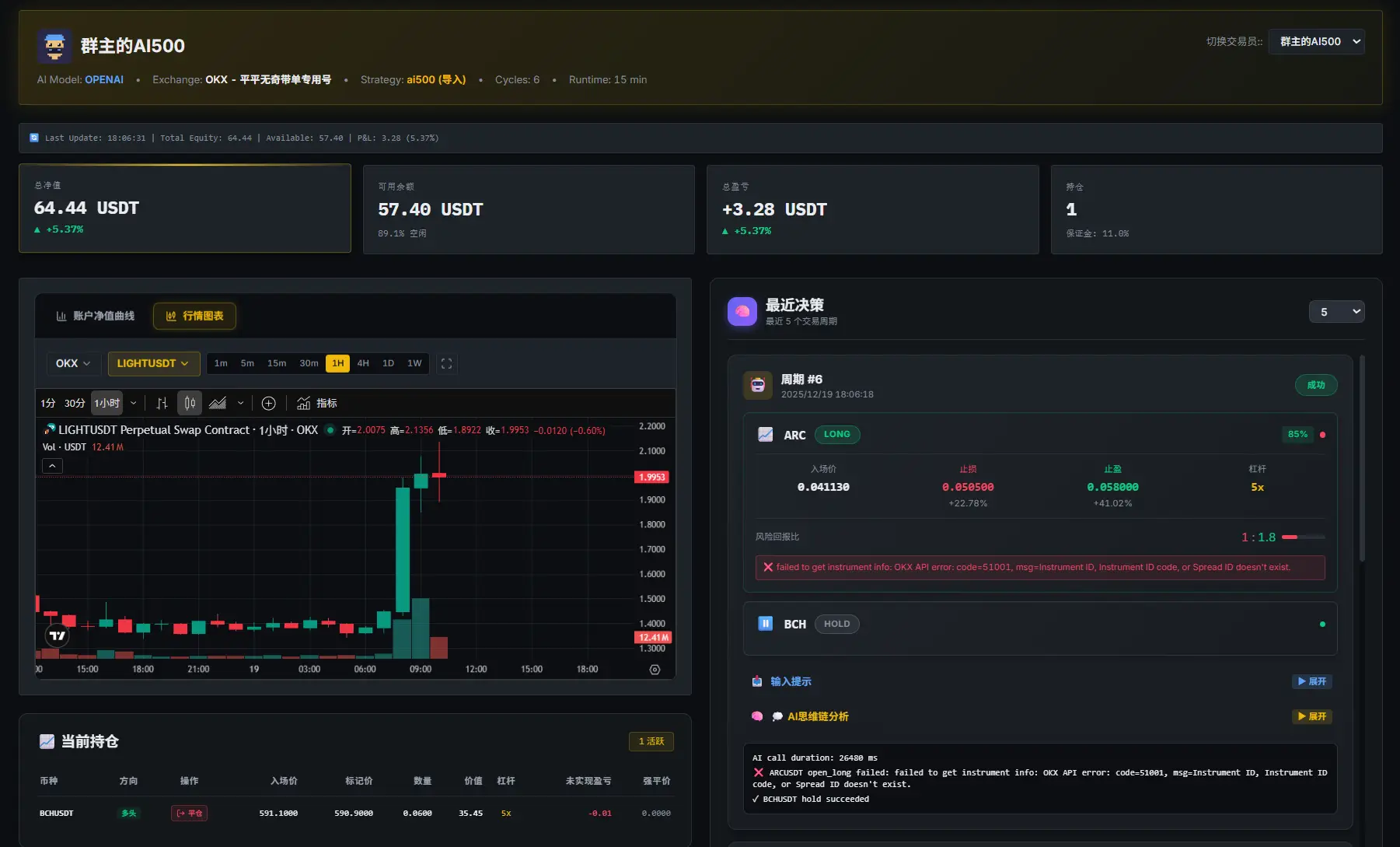

等新版本或者测试策略稳定吧。

等待审核的这功夫已经从最高+33 到 -33%了,看样子AI还是有点莽 🤣

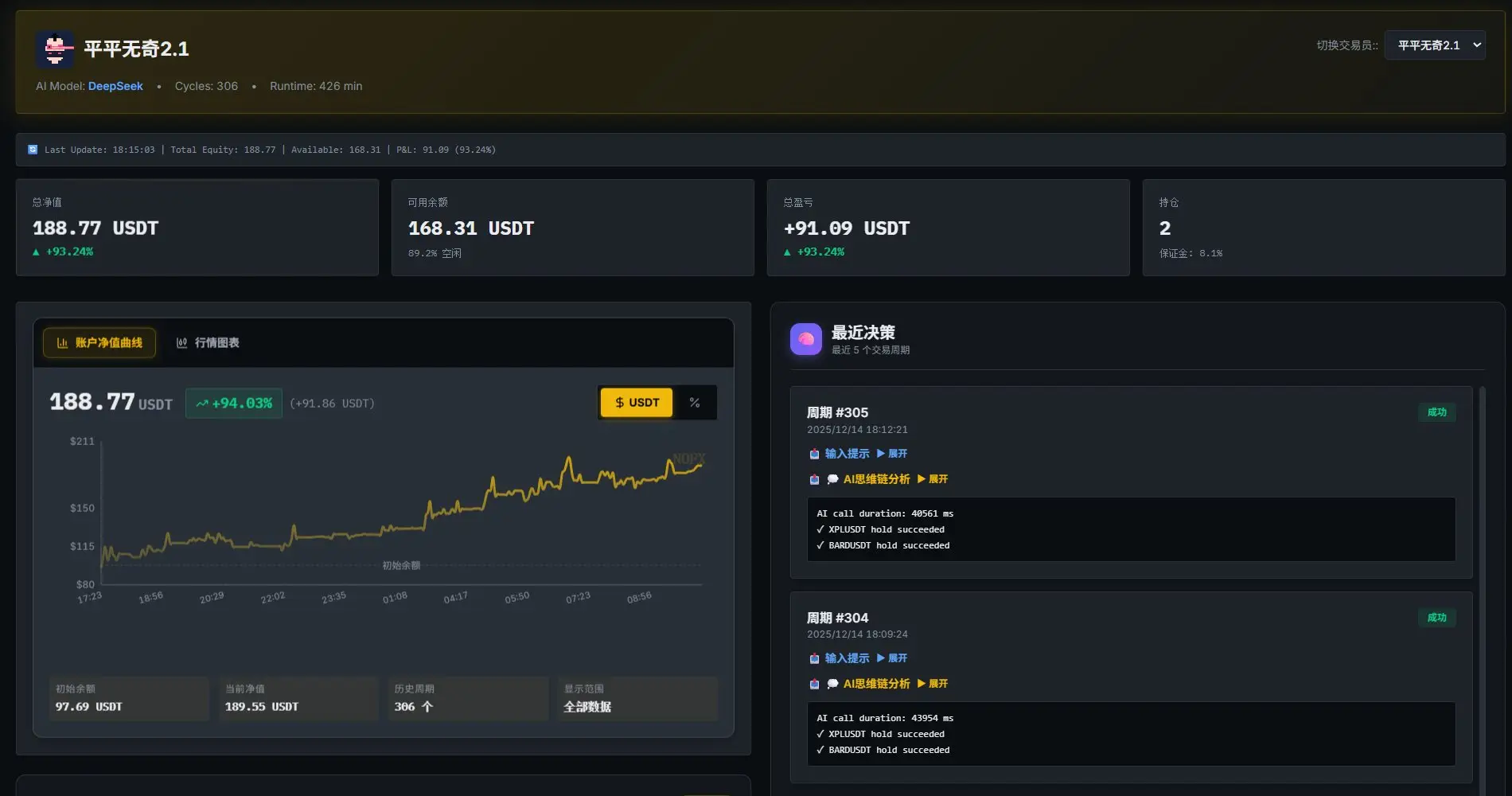

我总觉得开单得时机有问题。我翻倍了

https://i.ibb.co/KxLVJ0Ts/Pix-Pin-2025-12-30-00-53-57.png

确实时机不太对,现在Gemini3-flash已经自动亏到-60% ╮(╯▽╰)╭

快停了。你做的是7币种还是AI筛选币种的?